How do you track the engagement and risk status for each of your clients? At least for the high priority and strategically important customers.

How do you ensure that your team does not ignore those subtle, unstated early warning signals a customer might give. Signals such as a passing comment about dissatisfaction with some product features or service quality. Or constant delay in payments or irregular response to your emails.

The last few months have been very testing and uncertain for humanity. The threat and spread of Covid-19 has slowed down economies, industrial output and business activities. This entire episode will have a longer impact on the overall way of living and working. Consumers and businesses will be circumspect. Discretionary spends will be cut down and each line item in the balance sheet will be scrutinised. New customer acquisition will be relatively difficult and expensive.

More than ever before, customer retention has to be a top priority for businesses.

Given below is the link for an easy to use, Free client engagement and risk tracker developed by XServe Consulting, a business strategy consulting firm from Mumbai, India.

How to use the template:

- Click on the link above the image

- You may download the tracker as a Microsoft Excel template (File > Download > Microsoft Excel (.xlsx)

- Or if you are signed in with a Gmail account (recommended), you can copy the tracker as a GSheet to your Google Drive (File > Make a copy)

- Delete the sample entries. Do not delete entries in columns E, G, Q and R

- Enter the details in the sheet “Risk Tracker” – columns B to D, column F and columns H to P

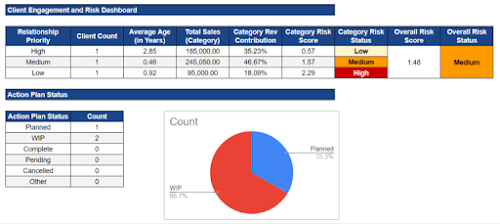

- You will get the Risk Score (column Q) and Risk Status (column R) for each client entry

- Fill details in columns S to X on what actions you plan to take to mitigate the risk for each client

No comments:

Post a Comment

Thank you for visiting my blog. Please subscribe for more articles and updates. Thank you!